Kategória: Research Blog

Forrás: https://digitalistudastar.ajtk.hu/en/research-blog/understanding-v4-russian-energy-markets-the-effect-of-eu-sanctions-and-the-future-of-central-european-energy-security

Understanding V4 & Russian energy markets, the effect of EU sanctions, and the future of Central European energy security

Szerző: Eric Peters,

Megjelenés: 04/2018

Reading time: 15 minutes

Whenever discussing European geopolitics, energy is always at the forefront of the conversation. For V4 leaders, there is a constant need to better grasp how Czechia, Hungary, Poland, and Slovakia rely on Russia for their energy needs. The ever-evolving nature of this topic only magnifies the importance of energy security for V4 nations. This blog post will show the complex relationships between sanctions, V4 energy dependencies, and natural gas and petroleum markets—and this can be very useful if policymakers are to forge a path into secure energy future.

Introduction

Whenever discussing European geopolitics, the topic of energy is at the forefront of many leaders’ minds. For V4 leaders, there is a constant need to better understand how Czechia, Hungary, Poland, and Slovakia rely on Russia for their energy needs. The present blog post, aiming at elaborating this topic, will be split into four parts: 1) a review of how the 2014 EU sanctions target certain Russian energy entities, 2) an overview of the V4 dependence on Russian energy imports, 3) an exploration of the natural gas and petroleum V4–Russian relationships, and 4) a discussion of current developments in the field and how Russian energy dependence may expand or shrink.

Who is Sanctioned?

As our first table shows, the largest Russian energy companies have all been restricted in some way by sanction policies in the wake of the Russian–Ukrainian conflict. Among the entities listed below, all possess significant shares of the Russian energy industry.

|

Name |

Sector |

Sanctioning Government(s) |

Important Details |

|

|

Rosneft |

Energy |

EU, US |

Second largest energy company in Russia. |

|

|

|

Gazprom Neft |

Energy |

EU |

Oil arm of Gazprom. |

|

Transneft |

Transportation |

EU |

Owner of all crude oil pipelines in Russia. |

|

|

Gazprom |

Energy |

US |

Largest company in Russia. Often used for geopolitical purposes. |

|

|

Lukoil |

Energy |

US |

||

|

|

Novatek |

Energy |

US |

Largest independent Russian natural gas producer. |

|

Surgutneftegaz |

Energy |

US |

||

|

Bold indicates an entity sanctioned by the EU. |

||||

Source: U.S. Executive Order 13662; European Council Decision 2014/512/CFSP, 2014/659/CFSP Significant Russian Energy Entities Targeted by Western Sanction Policy

Significant reasons exist which explain the discrepancy between the EU’s sanction policy and the United States’ policy, related to the Russian energy sector. The EU names the oil industry only, whereas the United States names both industries—oil and natural gas. The strategic motivation for the EU to only sanction oil, and not natural gas, arises from the European dependence on Russian natural gas.

V4 Dependencies

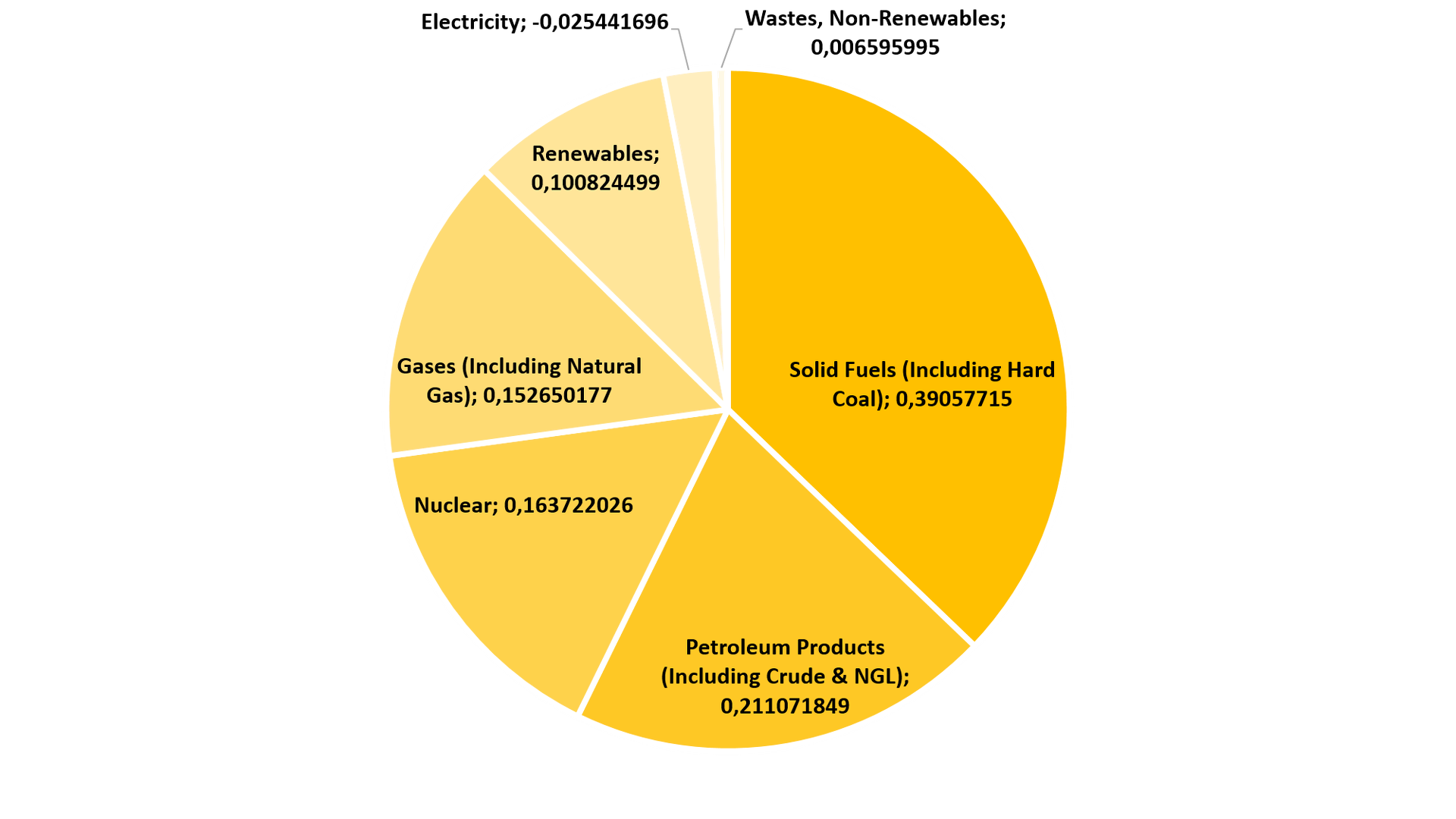

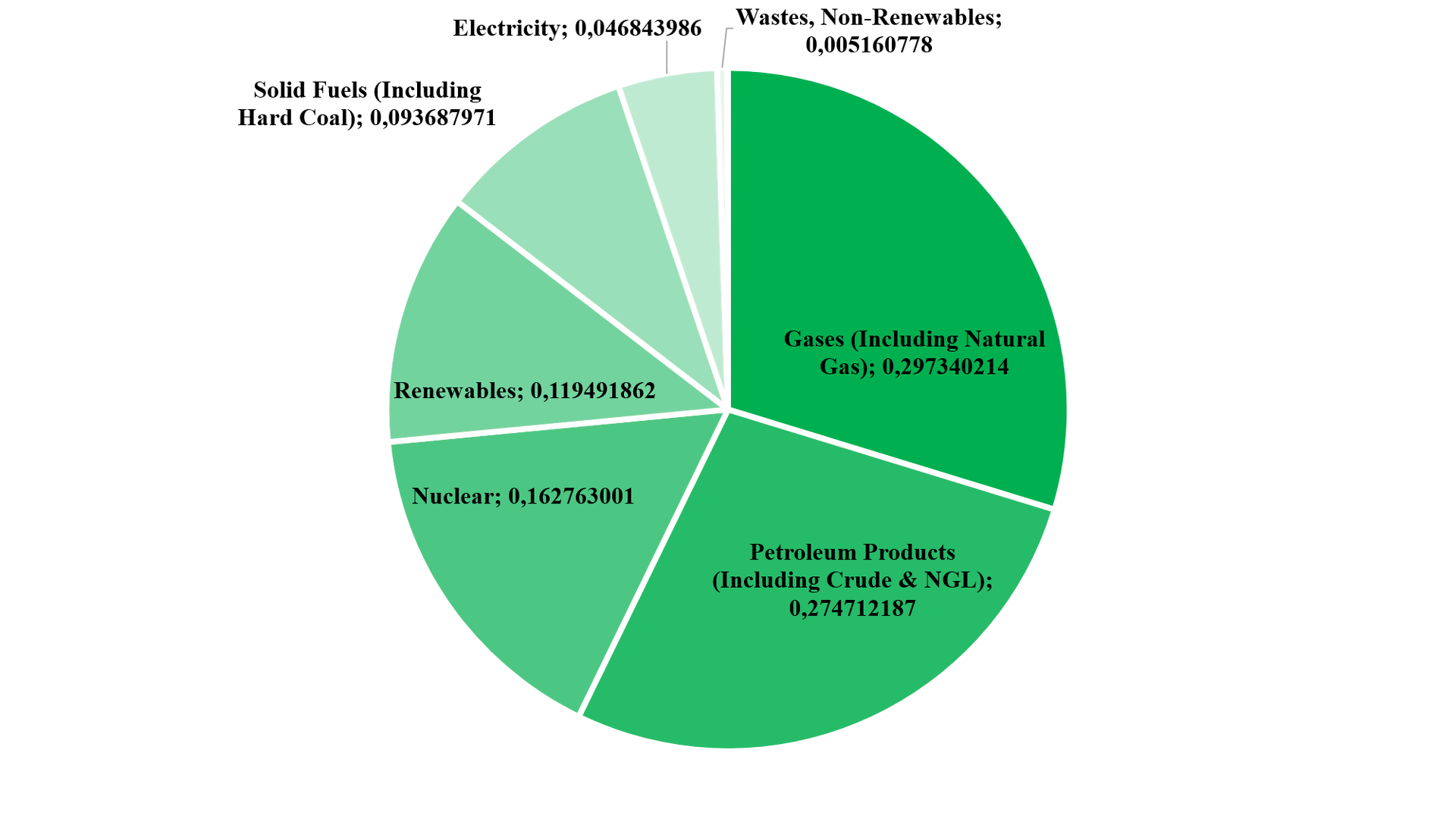

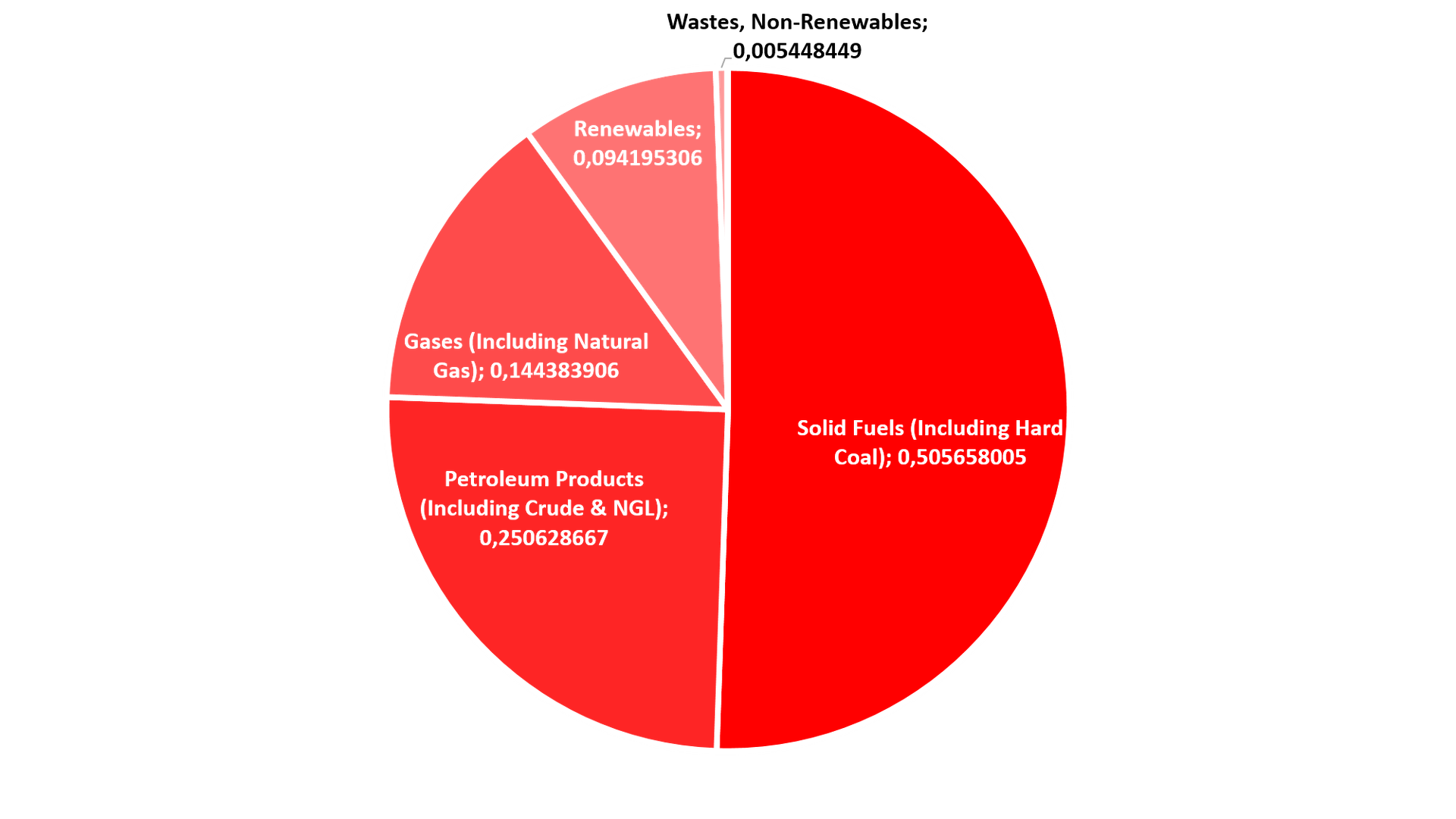

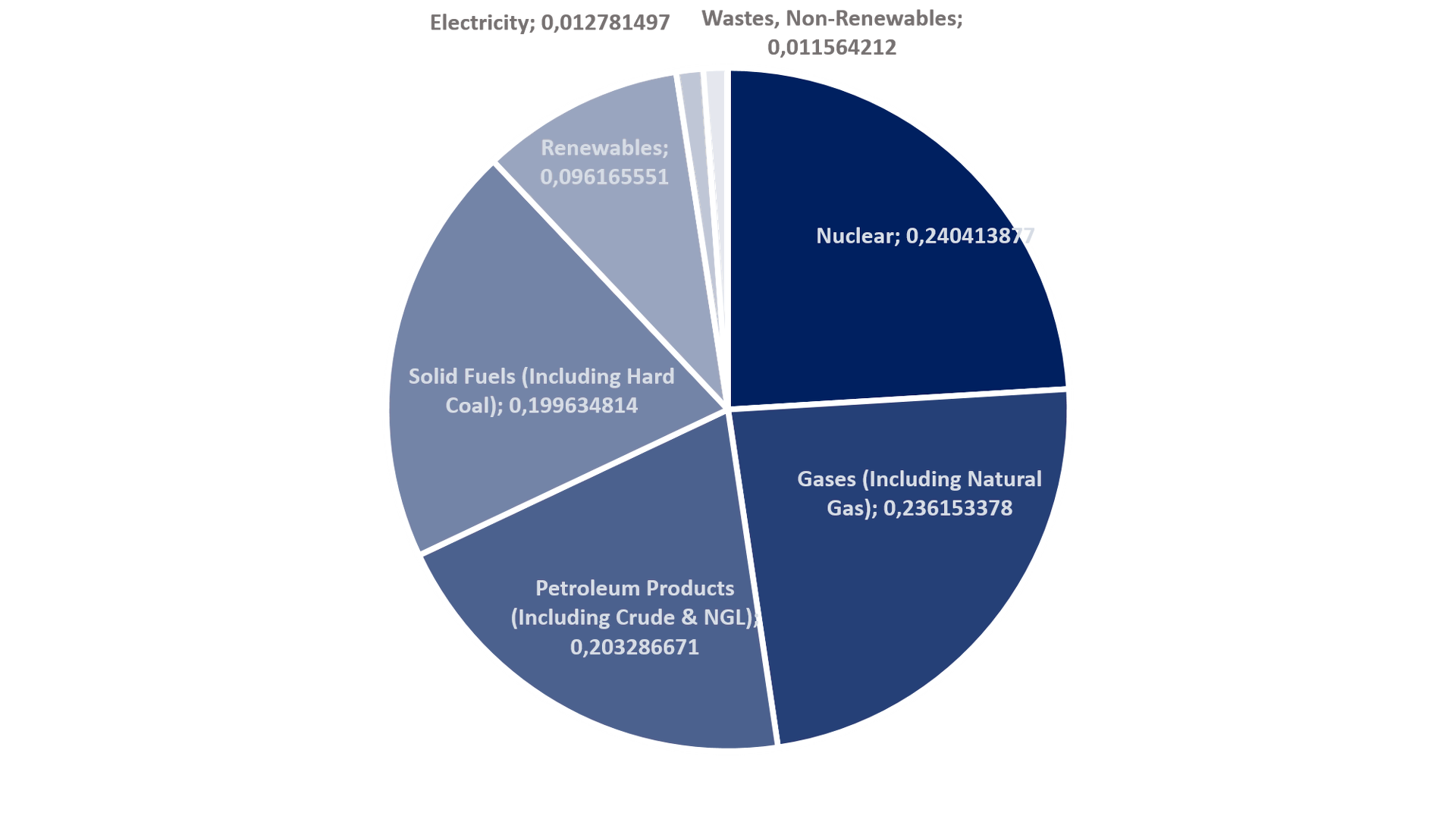

In order to appropriately understand the energy security concerns of each V4 nation, it is first important to recognize each countries’ respective energy mix. Czechia, Hungary, Poland, and Slovakia all exhibit a strong reliance upon traditional fossil fuels for their primary energy supply.

Czechia Gross Inland Consumption Energy Mix (2015)

Czechia Gross Inland Consumption Energy Mix (2015)

Source: EU Energy in Figures. Statistical Pocketbook (2017), AJTK Calculations

Hungary Gross Inland Consumption Energy Mix (2015)

Source: EU Energy in Figures Statistical Handbook (2017), AJTK Calculations

Poland Gross Inland Consumption Energy Mix (2015)

Source: EU Energy in Figures Statistical Handbook (2017), AJTK Calculations

Slovakia 2015 Gross Inland Consumption Energy Mix

Source: EU Energy in Figures Statistical Handbook (2017), AJTK Calculations

Having established that each V4 country relies heavily on natural gas and petroleum for a large share of their energy mix, the next question is what portion of these products are sourced from Russia?

Petroleum

Of EU sanctioned Russian oil companies, Rosneft and Gazprom Neft (an oil-focused subsidiary of natural gas giant Gazprom) possess the 1st and 4th largest shares in Russian market respectively, with shares of 37.8% and 10.5%. Transneft, the largest oil pipeline transporter in the world, is also sanctioned. Transneft transports 85% of oil extracted in Russia, is 100% owned by the Russian federal government, and owns and operates the Druzhba (Friendship) pipeline, which is the longest pipeline on Earth and crosses all four V4 countries. Back to Central Europe, if EU sanctions target entities that produce approximately 50% of Russia’s total crude oil and transport 85% of that oil, it is important to know what percentage of V4 crude oil imports originate from Russia?

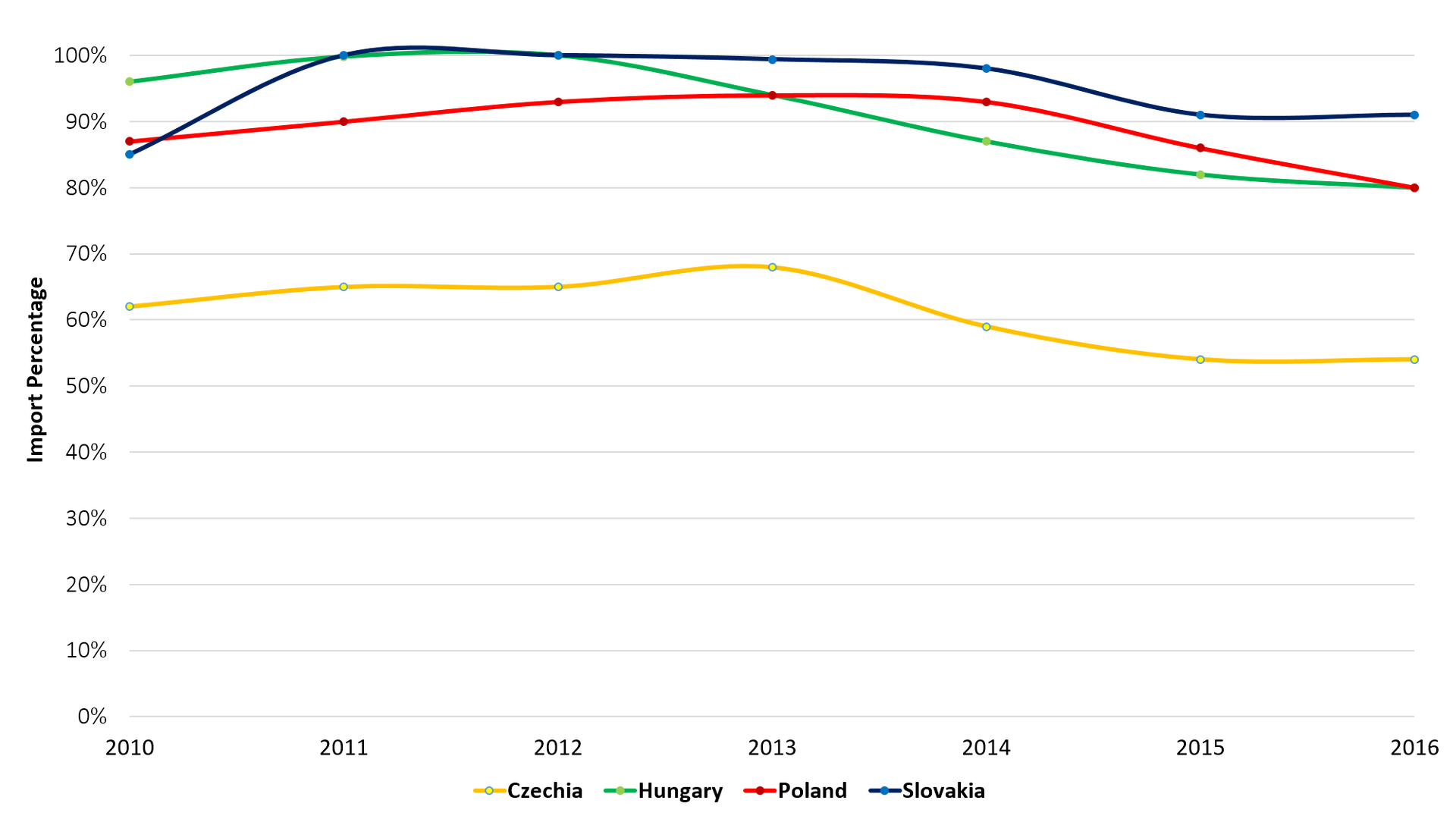

Russian Share of V4 Crude Oil Imports (2010–2016)

Source: Observatory of Economic Complexity, AJTK Calculations

As the above figure shows, V4 countries are highly reliant on Russian crude oil. However, structurally, this reliance should not be a great concern for V4 policymakers for two reasons. First, the EU, in total, receives 80% of its crude oil via sea transport and vehicular transport. Only 20% of EU crude oil arrives via pipeline. The highly developed European oil tanker industry also provides Poland with the ability to directly alter its supply source anytime. For land-locked Czechia, Hungary, and Slovakia, the option of vehicular transport to receive petroleum also provides a hedge against Russian supply risk. Secondly, hundreds of refined oil products, in addition to national crude prices, are tied to the price of the Brent Crude benchmark price. So, despite the size of their oil industry, Russians cannot single-handedly maneuver global prices to fit Russian interests. Simply, too many other actors and market dynamics are in play.

Natural Gas

While no Russian natural gas firm faces EU sanctions, when discussing the European natural gas market, gas giant Gazprom must be highlighted. Gazprom dominates the Russian market with a 65.5% share, and is majority owned by the Russian government, which provides it with exclusive right of being the sole legal exporter of pipeline natural gas. This has led to a de facto monopoly on the Russian natural gas industry via the sole legal right to export gas internationally. This easily affords the Russian government an incredible amount of economic and political leverage over countries dependent on Russian natural gas.

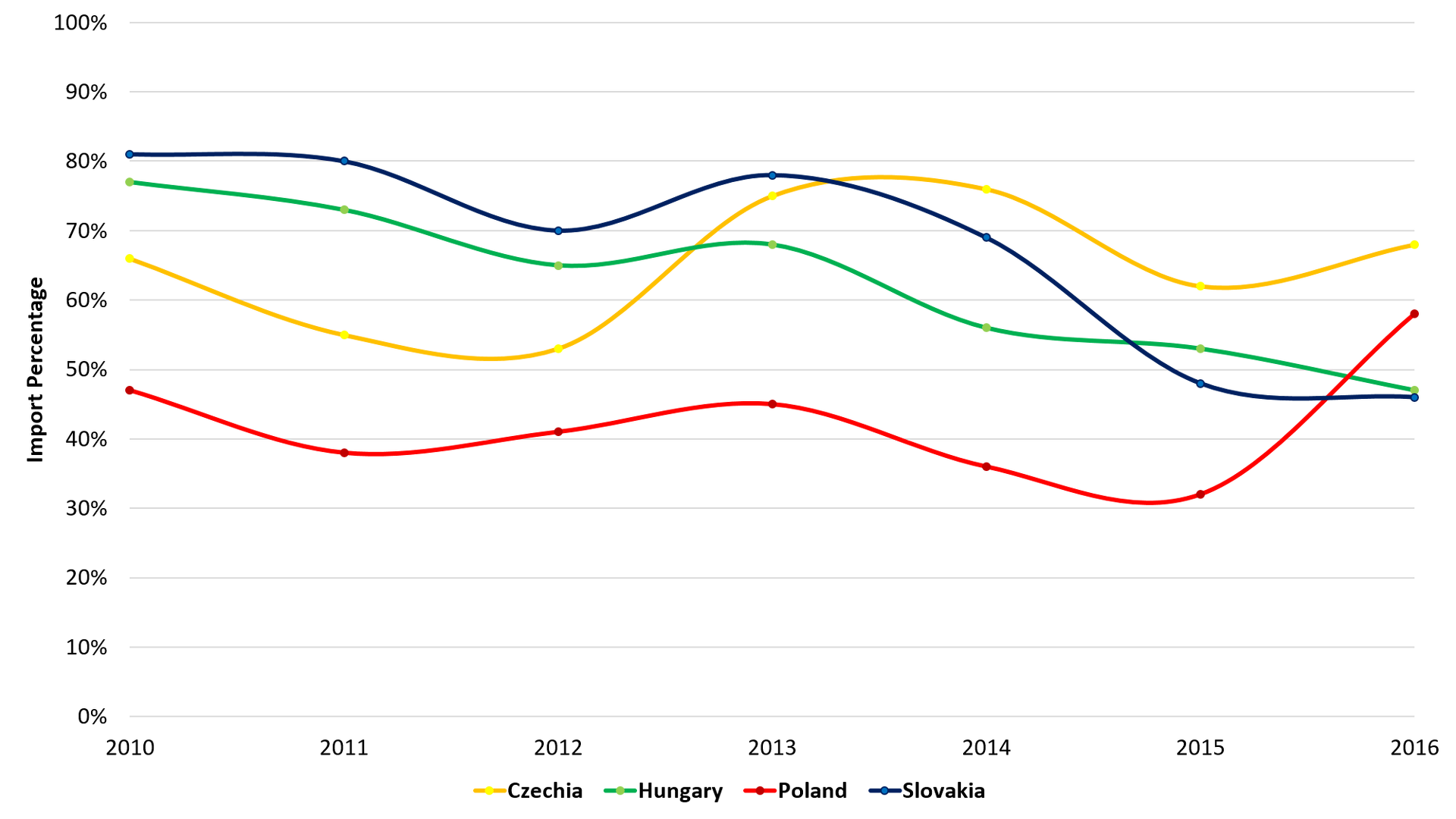

Russian Share of V4 Natural Gas Imports (2010–2016)

Source: Observatory of Economic Complexity, AJTK Calculations

As the above figure shows, Russia owns a dominant position in each county. Ranked for every year from 2010 to 2016, Russia is the #1 import originator for natural gas for all V4 countries. On average, during this seven-year time period, Czechia, Hungary, Poland, and Slovakia have imported 65%, 63%, 42%, and 67% of their natural gas from Russia respectively. But what does this mean? Should policymakers be concerned?

Many of the most critical gas pipelines that supply Europe either originate in Russia or pass through Russian territory. Related, in 2016, Russian natural gas imports compromised 39.5% of the total share of EU natural gas imports. So, V4 nations face difficulties in simply sourcing natural gas from other EU countries, as the supplier remains the same. Differing from petroleum markets, national and local natural gas prices are not as strongly tied to a global benchmark, affording Gazprom and Russia a strong market power over pricing. Natural gas markets are structurally rigid. This is a great energy supply security concern for EU and V4 leaders.

Future Geopolitical Considerations

As supply (Russia) and demand (EU & V4) struggle against one another for market power, each side is developing new tactics to gain an edge. For Gazprom and Russia, the further construction of pipelines to Europe remains the objective. Specifically, there are three pipelines, either being constructed or considered, which satisfy the dual goals of 1) bypassing Ukraine and 2) creating a direct supply link with Western Europe. Often mentioned in the news, South Stream (now canceled), Turk Stream (under construction), and Nord Stream II (under construction) would further solidify Russia’s market dominance in the EU and V4. While Nord Stream II faces legal challenges from Poland, the completion and use of Nord Stream II is most worrisome for V4 and Baltic countries.

For the EU and V4, especially in light the 2014 EU sanctions, the aspiration of energy diversification has never been greater. In diversifying their supply base, Central and Eastern Europe in particular aim to loosen the economic influence of their easternmost neighbor. Via the Three Seas Initiative, the Baltic, V4, and Black Sea countries are aiming to create a North–South energy corridor that would provide an alternative supply path. Functionally, this manifests itself in the creation of the Trans-Anatolian Natural Gas Pipeline (TANAP) and the Trans-Adriatic Pipeline (TAP) to access Azerbaijani gas resources to allow for a southern supply alternative from a country other than Russia. This would supplement other efforts to increase flexibility of movement for existing supply within the V4; V4 nations are also attempting to add dual-flow capabilities to existing pipeline networks to allow for greater supplier flexibility. Finally, and most importantly, the liquefied natural gas (LNG) market could break the Russian monopoly by creating a globalized market place. LNG could be transported via sea vessels, allowing for a global equilibration of supply and demand. Poland already possesses an operating LNG terminal and another under construction. Projected to grow sharply over the coming years, the development of the LNG market could be the best insurance for V4 energy security to date.

Conclusion

The goal of this post was to explore the connection between the V4 nations of Hungary, Czechia, Poland, and Slovakia and Russia within the context of the energy industry and EU sanction policy. EU sanctions target Russian entities whose primary business interests are within the petroleum industry—Rosneft, Gazprom Neft, and Transneft. With the exception of Rosneft, EU sanctions do not affect Russian natural gas-focused businesses (e.g. Gazprom) though, contrary to US sanctions. Despite recent strides to decrease imports from Russia, all V4 nations demonstrate considerable dependency on petroleum and natural gas to satisfy their energy needs. Russia ranks as the #1 source of these products for each V4 nation. While Russia possesses a greater V4 import share of crude petroleum than natural gas, oil markets showcase markedly different transport and price structures, which render Russian dominance much less strategically important. The robust nature of the European midstream, when combined with a globalized market pricing design, allows V4 nations to respond sufficiently to Russian oil supply shocks. Unfortunately, equivalent hedges are not present for Czechia, Hungary, Poland, and Slovakia against the Russian natural gas hegemony, while via the majority state-owned Gazprom, Russia is the most critical supplier of natural gas to Central Europe by a wide margin.

Supplementing the EU’s own sanction policy, the EU has suggested countries that show strong Russian natural gas dependencies, like the V4, should attempt to diversify their energy suppliers. Russia aims to negate these efforts by constructing additional pipelines into the heart of the EU. Via the Turk Stream pipeline and Nord Stream II pipeline, Gazprom has dedicated considerable resources to maintaining monopoly. To counter these Russian-led challenges, the V4, in collaboration with other Central, Eastern, and Southern European countries, have banded together to create the Three Seas Initiative with the stated goal of creating a North–South energy corridor. Through this informal alliance, equivalent efforts have been dedicated to the development of the LNG industry, appropriate dual-flow energy infrastructure, and southern gas pipeline alternatives (TAP & TANAP). With both sides, V4 and Russia, exerting resources to counter one another for market power, the future of the Central European energy industry is as dynamic and geopolitically critical as ever before. With all preceding initiatives either having their impetus rooted in EU sanction policy or affected by it, the future of V4 energy security looks to change significantly in the coming years, hopefully in favor of the V4 countries.

Opening pic by Shutterstock