Kategória: Research Blog

Forrás: https://digitalistudastar.ajtk.hu/en/research-blog/could-the-2014-ukrainian-incident-have-resulted-in-higher-gasoline-prices-for-you

Could the 2014 Ukrainian Incident Have Resulted in Higher Gasoline Prices for You?

Szerző: Eric Peters,

Megjelenés: 12/2017

Reading time: 12 minutes

Is it possible that the 2014 U.S. and EU-led Russian sanctions could have significantly affected the economic performance of Central Eastern European nations? If one of a nation’s biggest trade partners has an economy hampered by sanctions, it seems logical that costs could be passed onto end users. Our Fulbright intern colleague investigates this possibility within energy markets, specifically regarding changes in gasoline prices. This iteration of his research finds no significant relationship between the implementation of Russian sanctions and price increases for regional nations that import more than 50% of their crude oil from Russia.

Over three years have passed now since the United States and the European Union introduced the first round of economic sanctions upon the Russian Federation for their alleged role in the annexation/invasion of the Crimean Peninsula.

The renewal of these economic sanctions each year has corresponded with an increase in the quantity of voices in Central and Eastern Europe (CEE) nations which argue that these sanctions are harmful for their domestic economies. Such a reasoning is logical, considering the geographical and historical trade ties that have bound CEE nations and Russia. For my research, I felt this was an under-scrutinized topic which deserved further exploration. Are Western sanctions economically affecting CEE nations in some significant way? Are the voices spreading this message correct?

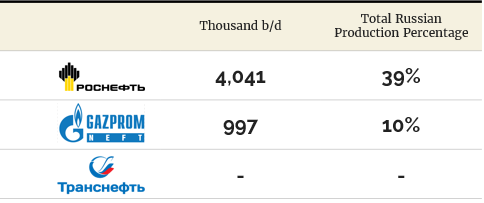

To review, U.S. and EU sanctions target particular Russian individuals and three core Russian industries – energy, banking & finance, and defense. Russia responded to these sanctions with counter-sanctions of their own, targeting certain American and European politicians and creating a de facto embargo on European agricultural imports. For this work, I chose to focus on the economic sector most vital for the health of the Russian economy and their greatest export to the EU – energy. Within the energy sector, Rosneft, Transneft, and Gazprom Neft are the three specific organizations designated by EU sanctions. Sanctions restrict the ability to trade debt and equity products of Rosneft, Transneft, and Gazprom Neft and do not allow them to raise capital in Western markets via products that exceed 30 days in maturity. Reduced financial flexibility should result in higher operational costs for these firms, which may be passed onto end (e.g. CEE) consumers. Rosneft, Gazprom Neft, and Transneft are all integrated into a variety of energy product value chains. So, to narrow things down further, I chose to focus on gasoline, a product that affects the daily life of almost everyone around the globe.

Now, to be clear, Rosneft, Transneft and Gazprom Neft were targeted for a reason. These are massive companies that are vital contributors to the Russian energy sector.

The three big Russian companies and their contribution to Russian energy sector

Source: University of Tennessee - Knoxville, author: Eric Peters, license: CC BY-NC-ND 2.0

Rosneft and Gazprom Neft together produce approximately half of the total oil in the Russian oil sector. Transneft is technically not a producer but owns the means of transportation for delivering oil to refineries and customers, making them strategically important in the industry as well.

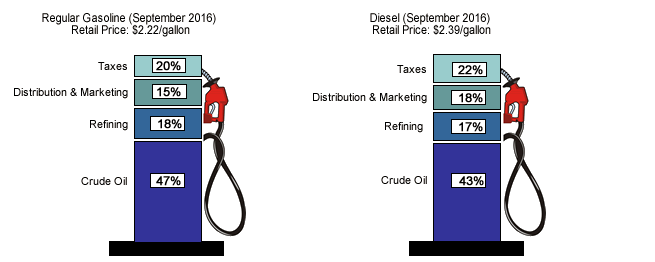

How though is gasoline priced? Is it logical that an increase in operational costs for these massive companies could be passed onto end consumers? The answer is yes. Gasoline prices are determined by four inputs – the price of crude oil, refining costs, distribution and marketing costs, and taxes.

How end customer prices are calculated?

Source: U.S. Department of Energy’s Energy Information Administration

With the exception of increased taxes, European gasoline price determinant percentages are proportionally similar to American gasoline prices. Important to note though is the location of these price determinants. Crude oil is imported. Refining, distribution and marketing, and taxes are typically administered in country. The number of refineries in Europe has not changed since the implementation of the 2014 sanctions. Also, tax rates have not changed either. Distribution and marketing costs are extremely localized and therefore hard to measure. However, the price of crude oil is measurable daily and, as seen above, is the main price driver of gasoline prices. Therefore, if the price of crude oil is controlled for, as the most significant and volatile driver of gasoline prices, then perhaps we may be able to isolate the effect of a rise in operational costs for at the front end of the value chain too. This would be highly reliant on identifying countries who import a large percentage of their crude oil from Russia.

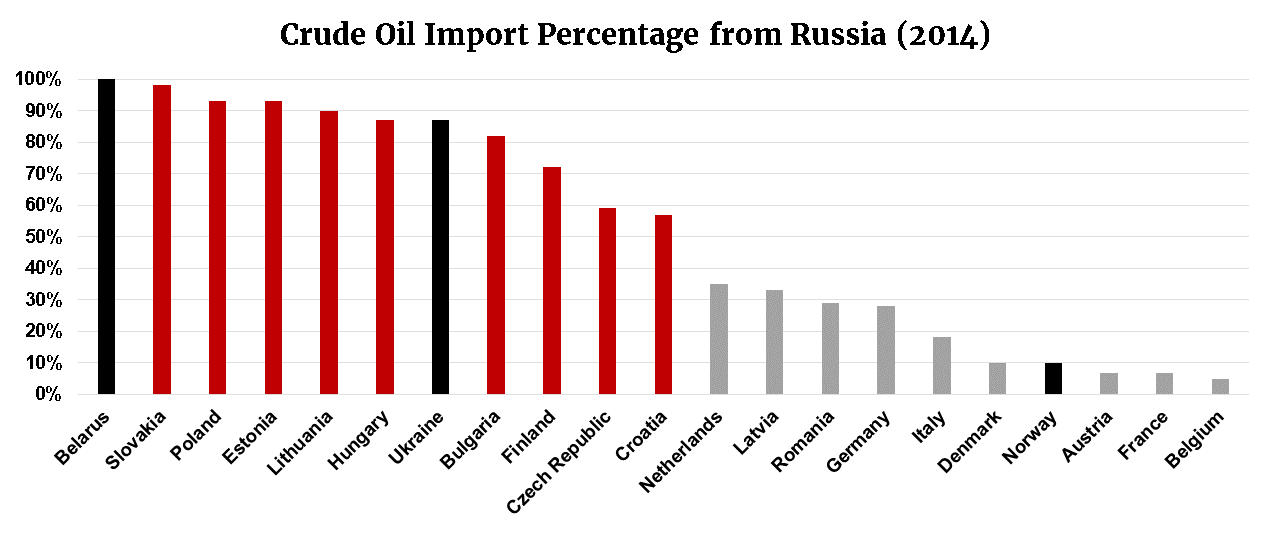

Fortunately, Russia is the largest oil supplier of Europe, and within this, many nations reliance on Russian oil is heavily concentrated.

How much crude oil do European countries import from Russia?

Source: University of Tennessee - Knoxville, author: Eric Peters, license: CC BY-NC-ND 2.0

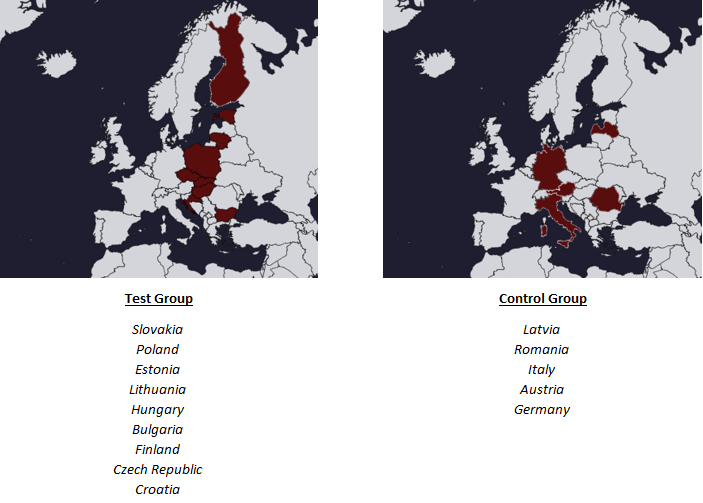

For the above figure, red bars designate EU countries that imported 50% or more of their crude oil from Russia, while grey bars identify EU countries that imported less than 50%. Black bars designate non-EU European nations. Using these import percentages, I formed two groups – a test group of nine nations highly dependent on Russian imports and a control group of five nations which is not as dependent. Above, you can see the geographical distribution of these two groups.

Source: University of Tennessee - Knoxville, author: Eric Peters, license: CC BY-NC-ND 2.0

And so my research question crystallized into this: Did the 2014 EU sanctions on Russia for their involvement in the Crimean Annexation/Invasion have a positive price effect on the average price of unleaded and diesel fuel for EU nations with 50% or more dependence upon the Russian supply of crude oil imports?

Via collecting monthly data from January 2008 through December 2015 for each country in my 14 nation sample, I developed a differences-in-differences econometric model that would explain the average monthly gasoline price for each country for both unleaded gasoline and diesel gasoline. All variables were denominated in US$ when possible and at the appropriate foreign exchange rate. For explanatory variables, five variables were chosen:

- Gasoline Price/Brent Crude Price: a proportional variable to account for the Brent Crude price, or the largest driver of gasoline prices worldwide, while also reducing the extreme effect of the Brent Crude price via a transformation. This variable was lagged three times as well to account for the time it takes for oil to move throughout the value chain.

- GDP per Capita: a US$ denominated variable for the use of general economic performance by country.

- Dummy Variable #1: a dummy variable used to identify my test group.

- Dummy Variable #2: a time dummy variable to isolate monthly time periods after sanctions were implemented.

- Dummy Variable #3: a dummy variable used to measure the interaction effect between Dummy Variable 1 and Dummy Variable 2.

Fixed effects was also used to account for time-invariant and country specific factors like infrastructure and driving culture.

After running this analysis, my results were surprisingly inconclusive for this iteration. My statistical output showed that my model was statistically significant in explaining price changes in average monthly gasoline prices. However, Dummy Variable #3, which measures if there is a significant effect on prices resulting from the interaction of a high dependence on Russian crude oil imports and time periods occurring after the implementation of Russian sanctions was statistically insignificant. This was the variable we most needed to be statistically significant in order to be able to reject the null hypothesis that the 2014 Russian Sanctions had no impact on the average monthly gas prices for highly dependent European nations.

Despite theory being supportive of a possible relationship, there are a number of other factors that could have influenced my results. Many such factors revolve around the difficulty of separating out the effects of the global downturn in crude oil prices from the actual economic effects of the Russian sanctions. As Russian sanctions were enacted, global Brent crude prices faced downward pressure from OPEC oversupply, a strengthening U.S. dollar, and weak G7 growth. This complicates proper identification of the effect of Russian sanctions on European prices for both unleaded and diesel gasoline. In the future, there are a variety of alternative methods that I aim to pursue in order to continue my work on this topic. Despite the inconclusiveness of my research, the importance of this research has never been greater. Regardless of political affiliation or ideology, a greater quantity of robust economic research is always to be preferred to a lesser quantity. I hope this research is found useful by policymakers as they continue to tackle ever-evolving challenges of today.

For more information and to read my whole research paper, please follow this link.

Opening pic: Shutterstock